Poplar Homes Reviews and Case Studies

Hear what our customers say!

Key Takeaways:

- Try self-managing your property to understand what being a landlord is like. The experience can be rewarding or gruesome.

- If your rental property is in a different city, a property management would work best for you. Your time is valuable and should not be spent driving city to city for an open house.

- Even newly-purchased homes have inevitable maintenance issues. Look for a rental service with transparent maintenance and no markups.

Background

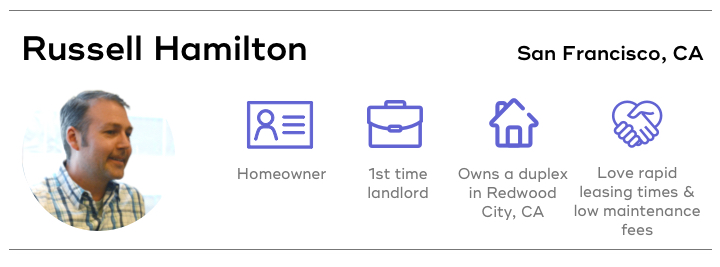

Russell Hamilton first dipped his toes into real estate after being advised to look into long-term rental investments by his financial manager. This was uncharted territory for Russell because his career thrived on Wells Fargo’s innovation team in their San Francisco office.

In late 2015, Russell and his wife purchased a duplex in Redwood City with the intention of self-managing it. Soon they would learn that renting a property in the San Francisco Bay Area is easier said than done. In this Poplar Homes review, we will examine how Russell Hamilton remedied all his real estate investment concerns with Poplar Homes Property management.

Challenge

Even for those owners with only one property in their portfolio, self-managing a property looks easier on paper. Sure you can do all of your homework ahead of time and get a good idea of how the process would look, but planning and executing are two completely different beasts. Russell Hamilton used to think self-managing his rental was what he preferred. He soon realized that his time was better spent at his job at Wells Fargo or with family.

A common misconception for new real estate investors is the amount of work it takes to get a rental property off the market.

“In the Bay Area we knew how hard it was to find a place to live, so we hoped it would just sell itself.”

– Russell Hamilton

Eventually, he found himself running out of strategies to effectively attract and screen renters. He posted ads on Craigslist and nailed a FOR RENT sign on the lawn for two months with no success. Then, he got a call from a Poplar Homes’ market specialist offering to perform a free rent analysis on the troublesome property. “I’m running out of options,” he thought, “so why not”?

Poplar’s tech-enabled approach to rental management delivered him the leasing and maintenance services that he had sought all along while giving him free time back in the process.

Solution

After Poplar placed a qualified renter in less than 2 weeks, Russell knew this would be a long-term partnership. Reflecting on the obstacles he faced while self-managing, Russell said he “loved how Poplar did all the work of screening renters and conducted showings to get the place rented without any additional fees.”

Even newly purchased homes usually have a few minor maintenance items that need to be addressed. As Russell and his wife purchased the duplex with the intention of renting it out, there was some minor maintenance work that had to be done two weeks prior to move-in. Poplar proactively took care of these issues before the new renters moved in.

He was especially pleased with the 24/7 maintenance service, specifically because it had transparent pricing and no markup fees for jobs. This was a surprise because several of his friends’ property managers marked up maintenance after repairing properties.

First-time real estate landlords often struggle with balancing time and responsibilities between their primary job and their rental. Russell felt his time at Wells Fargo was more valuable to him than driving up and down the peninsula hoping to rent out the duplex. Now that he’s gotten a taste of positive cash flow from his duplex, expanding his investment portfolio by purchasing more property is on his horizon.

Let us know what you’ve thought about Russell’s Poplar Homes review and experience in the comments below!

Recent Comments